When thinking about retirement, it can be overwhelming to figure out all the right questions to ask, such as what age you’re going to retire, how much money you need, how long do you need the money to last, and do you need or qualify for government assistance.

Income Needs

- Did you Know… for two people in retirement (for 20 years) to eat 3 meals a day at $5.00 meals it will cost $219,000 just to eat! What if you want to eat $10.00 meals, or $20.00 meals?

- Determine how much you need in retirement.

- Make sure you account for inflation in your calculations

- Understand where your income will come from while in retirement.

Debts

- There are good debts and bad debts.

- A good debt is against an asset that increases in value over time.

- A bad debt is a debt that has no asset that appreciates but the compound interest is so high that it takes years to pay off.

- If you have any debts, you should try to pay off your debts as soon as you can and preferably before you retire.

Insurance

- As you age, your insurance needs change. Review your insurance needs, in particular your medical and dental insurance because a lot of employers do not provide health plans to retirees.

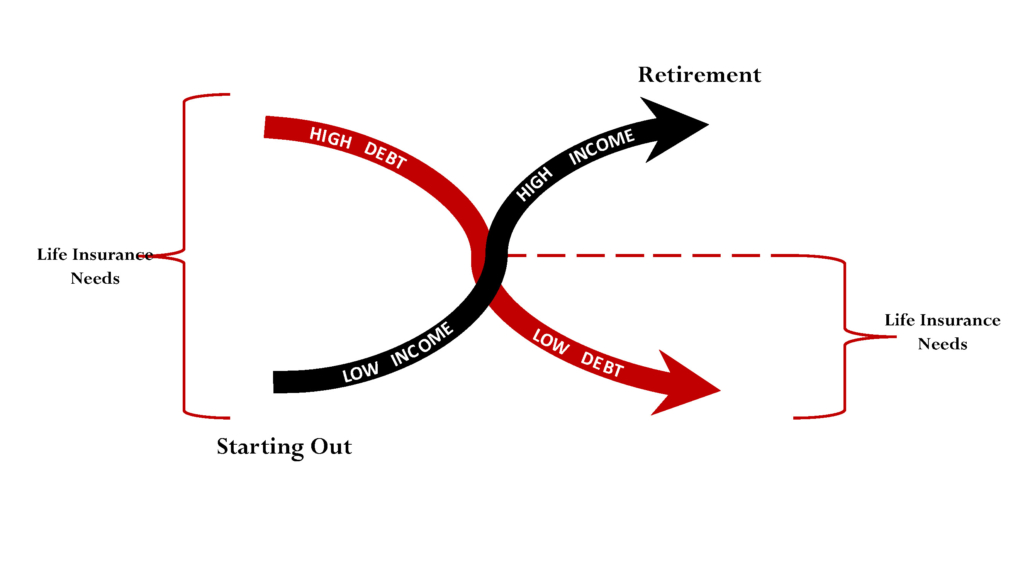

- Review your life insurance coverage because you may not necessarily need as much life insurance as when you had dependents and a mortgage, but you may still need to review your estate and final expense needs.

- Prepare for the unexpected such as a critical illness or long term care.

Insurance is the foundation of your financial plan. It is the risk management portion that most people don’t think they need. Let’s take a closer look at what it really is.

First is Life Insurance –

- If something happens to you and you pass away, how will your estate be handles? Can your executor afford to cover all your debt and final expenses?

- Most Executors / Executrixes will pass on the appointment if there is no money to settle the estate. Life insurance can help with this.

- Life Insurance provides income replacement for a period of time for your loved ones.

- Provides funds to pay off debt like mortgage and property tax with utilities for a period of time.

- Provides funds to pay off Loans, LOC, Credit Cards, and any other medium and long term debts.

As you move through the stages of life your income should increase and your debt should decrease. There will be changes in the amount and type of life insurance needed.

Second is Living Benefits –

- Living Benefits is there for income replacement when you are injured or ill and are unable to work, or to help cover the costs of day-to-day living.

Government Benefits

- Check what benefits you will be eligible for when you retire.

- Canada Pension Plan- decide when would be the ideal time to apply and receive CPP payment. (Payment depends on your contributions)

- Old Age Security- check pension amounts and see if there’s a possibility of an OAS clawback.

- Guaranteed Income Supplement- if you have a low income, you could apply for GIS.

Income

- Understand what benefits you will be eligible for when you retire.

- Review your company pension plan. Check if it’s a defined benefits or contribution plan. Determine if it makes sense to take the pension or the commuted value.

- Make sure you are saving on a regular basis towards retirement- in an RRSP, TFSA, LIRA or non-registered. Ensure the investment mix makes sense for your situation.

- Are there any additional income sources? For example. rental income, outside business activity, etc.

Assets

- Understand what benefits you will be eligible for when you retire.

- Review your company pension plan. Check if it’s a defined benefits or contribution plan. Are you planning to use the sale of your home or other assets to fund your retirement?

- Will you be receiving an inheritance?

One other consideration that’s not included in the checklist is divorce. This can be an uncomfortable question, however divorce amongst adults ages 50 and over is on the rise and this can be financially devastating for both parties.

Next steps…

- Other considerations not included in the checklist are divorce and the passing of a child(ren) or partner. This can be an uncomfortable conversation; however, divorce amongst adults ages 50 and over is on the rise. Both of these circumstances can be emotionally and financially devastating.